Research and Analysis Report on Polyacrylamide Industry

Research and Analysis Report on Polyacrylamide Industry

1. Overview of the Development of Polyacrylamide Industry

Polyacrylamide (PAM) is a collective term for homopolymers of acrylamide or copolymers with other monomers. Polyacrylamide is one of the most widely used water-soluble polymers. Polyacrylamide is widely used in industries such as petroleum extraction, papermaking, water treatment, textiles, pharmaceuticals, and agriculture.

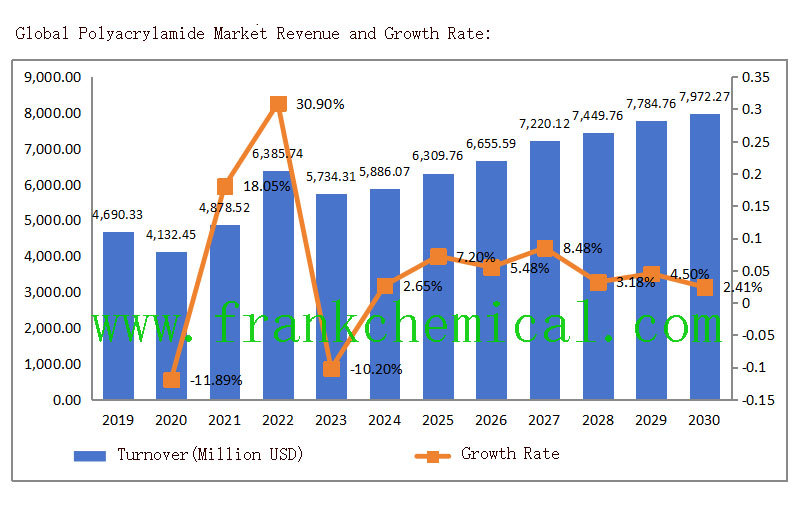

The global polyacrylamide market size was $469.033 million in 2019, and $5734.31 million in 2023. The compound annual growth rate (CAGR) for the five-year period from 2019 to 2023 is 5.15%. It is expected that the global scale will reach $7972.27 million by 2030, with a compound annual growth rate of 5.19% from 2024 to 2030.

The global sales volume of polyacrylamide in 2023 is 2407.6 thousand tons, and it is expected to reach 3652.2 thousand tons by 2030, with a compound annual growth rate of 5.83% from 2024 to 2030.

China is the world's leading producer of polyacrylamide, with a production capacity of 1366.3 thousand tons in 2023, accounting for 56.75% of the global market share. The size of China's polyacrylamide consumption market has grown from 1873.90 million US dollars in 2019 to 2322.09 million US dollars in 2023, with a compound annual growth rate of 5.51% from 2019 to 2023. It is expected that the size of the consumption market will increase to 3296.89 million US dollars by 2030, with a compound annual growth rate of 5.88% from 2024 to 2030.

From the perspective of product types, polyacrylamide mainly includes non-ionic polyacrylamide (PAMN), anionic polyacrylamide (APAM), cationic polyacrylamide (CPAM), and other types. Anionic polyacrylamide (APAM) is the main product type, with a sales volume of 1078.3 thousand tons in 2023, accounting for 44.79%.

From the perspective of product market applications, the main ones are water treatment, paper and pulp, oil and gas extraction, mining, agriculture and other applications. Among them, water treatment is the most important application, with product sales of 1045.7 thousand tons in 2023, accounting for 43.43%, followed by oil and gas extraction with sales of 663.5 thousand tons, accounting for 27.56%.

2. Main characteristics of the development of polyacrylamide industry

Polyacrylamide products belong to the industry sectors encouraged by industrial policies; Polyacrylamide belongs to the national strategic emerging industry products.

The polyacrylamide industry is a technology intensive and capital intensive industry. In an environment where safety and environmental policies are becoming stricter, the entry threshold and concentration of the industry are relatively high. The country implements an open policy for this industry, and the degree of marketization is relatively high.

3. Analysis of favorable factors for the development of polyacrylamide industry

3-1. [Downstream market capacity continues to grow]

Polyacrylamide products are widely used in downstream industries such as petroleum extraction, water treatment, papermaking and pulp making, textile printing and dyeing, and coal washing and beneficiation, with a wide range of market applications and high demand.

3-2. [Large export market space]

For a long time, large international chemical companies have held a significant market share in the global fine chemical industry due to their first mover advantage and outstanding technological strength, such as Solenis in the United States and SNF in France, which dominate the water treatment chemical market. The above-mentioned enterprises rely on the advantages of early start, rich business experience, and leading technological level, with a complete range of product series, high brand recognition, and leading the development direction of the industry.

The fine chemical industry in China started relatively late, but it has advantages such as low cost and high cost-effectiveness. In recent years, the export of domestic polyacrylamide products has gradually increased. With the further development of the international market, domestic polyacrylamide production enterprises will expand their market share in the international market.

In recent years, in order to encourage the development of the oil and gas drilling and extraction industry, various countries have successively introduced a series of incentive policies.

Polyacrylamide and its derivatives are mainly used in the field of third oil recovery and shale oil well fracturing, which can effectively improve oil recovery and fracturing efficiency, thus improving oil mining output. It is one of the main oil recovery additives.

4. Analysis of Adverse Factors in the Development of Polyacrylamide Industry

4-1. [R&D requirements are increasing day by day]

The polyacrylamide industry is a technology intensive industry, and the R&D capability of products directly affects the ability of enterprises to provide high-quality polyacrylamide to customers, which directly affects the application effect of downstream markets. At present, the insufficient research and development capabilities and low-level repetitive production of most domestic polyacrylamide production enterprises are the main factors leading to low profit margins and the threat of elimination for small and medium-sized polyacrylamide production enterprises. With the trend of customized and functionally differentiated requirements from customers for polyacrylamide, the difficulty of developing product formulas and processes has also increased.

4-2. [Fluctuations in Raw Material Prices]

Raw material costs are an important component of the production costs in the polyacrylamide industry, accounting for a relatively high proportion of production costs. Therefore, fluctuations in raw material procurement prices have a significant impact on the main business costs. The main raw materials are basic chemical products such as acrylonitrile, and their prices are greatly affected by market conditions and supplier production capacity. If there is a significant increase in raw material prices in the future, corresponding enterprises will not be able to respond effectively in a timely manner, and cost control will not be timely, which will have a significant impact on enterprise costs and profits.

4-3. The tightening of national environmental policies has led to an increase in costs

The production process of the fine chemical industry has a certain degree of pollution, and China's extensive economic development model of "pollution first, treatment later" in the early years has had a significant negative impact on the environment. With the increasing awareness of environmental protection in society and the tightening of national environmental policies, enterprises need to invest more funds in environmental protection and develop greener and more environmentally friendly products, which will increase the company's costs and compress profit margins.

4-4. The fluctuation of international oil and gas prices affects the number of oil well activities and expenditure plans of oil and gas companies

Recently, because the global economy is affected by many factors such as the COVID-19, the international crude oil price has fluctuated significantly. The rise and fall of international crude oil prices will directly affect the revenue and profits of oil and gas companies. If oil and gas companies adopt a strategy of reducing oil and gas production to stabilize crude oil prices, or reduce oil and gas exploration and production expenses, it will affect their expenditure plans. The exploration and development expenses of oil and gas companies directly correspond to the revenue scale of various oil service companies. Therefore, the prosperity of the oil extraction additives industry is directly affected by oil prices.

5. Barrier to entry into the polyacrylamide industry

5-1. [Technical and R&D Barriers]

The overall trend of the development of the polyacrylamide industry is towards products with multiple varieties, high performance, energy conservation and environmental protection. Different application fields have inconsistent demands for the performance of polyacrylamide products, such as flocculation, thickening, shearing, reducing and dispersing properties. Polyacrylamide products with different properties mean the diversification of raw material formulations and processing techniques, while technological research and development capabilities are the key factors determining formulation performance and process level.

Secondly, polyacrylamide is a complex product that needs to be adjusted according to the specific characteristics of the oil reservoir, the degree of exploitation, or the different composition of the wastewater to be treated to meet the different needs of customers, such as formula and ionization degree. It requires continuous technological development and application research of new products, and the investment in technological development is relatively high.

In order to adapt to the constantly increasing customer demands and the expanding application fields due to downstream industry development, polyacrylamide production enterprises need to have strong research and development capabilities. This industry has high requirements for enterprise technical reserves, professional competence of R&D personnel, industry experience, etc.

5-2. [Financial Barrier]

The government attaches great importance to the safety and environmental protection of chemical enterprises. From the perspective of development trends, due to the increasing investment in environmental safety, research and development, equipment and other related costs, some small and medium-sized enterprises that do not have scale and technological advantages will be eliminated. Large enterprises have strong bargaining power over upstream suppliers due to their large-scale production. The main raw material for producing polyacrylamide is acrylonitrile, which is supplied by petroleum refining enterprises. Large polyacrylamide manufacturing enterprises, due to their large raw material procurement volume, are easily able to form strategic partnerships with petroleum refining enterprises to ensure the supply of raw materials.

New entrants find it difficult to compete with existing ones in raw material procurement channels due to their smaller sales scale. At the same time, the Chinese chemical industry is constantly accelerating integration, and the operating scale of enterprises in the industry is increasing. The economies of scale in terms of capital and production are becoming more apparent. Therefore, new entrants find it difficult to form economies of scale and competitive advantages in a short period of time.

5-3. [Customer Access Barriers]

Due to the direct impact of the quality and performance of polyacrylamide products on the expansion of downstream market application areas, the downstream application areas of polyacrylamide are mainly customers in petroleum extraction, water treatment, papermaking and pulp making. The certification of suppliers by these customers is relatively strict, especially for petroleum extraction enterprises, which require a long-term and rigorous inspection and verification process for the certification of polyacrylamide suppliers. In general, the certification of petroleum extraction additives suppliers by well-known oil extraction companies in the industry includes qualification review, on-site evaluation, sample testing, trial production, large-scale production, and other processes, with a long certification cycle.

In the certification process, high-quality large customers not only have high requirements for the quality, price, and delivery time of related products, but also need to evaluate the manufacturer's production equipment, production environment, research and development capabilities, response speed, timely delivery rate, enterprise management level, internal control system, and other aspects from multiple perspectives. Once certified as a qualified or premium supplier by a high-quality major customer, the cooperation between upstream and downstream is generally more stable. Due to the high cost of supplier conversion, high-quality large customers will not easily change suppliers, therefore, there are substantial barriers to procurement certification for large customers in this industry.

5-4. [Talent Barrier]

Compared to the rapid development of the industry, there is a relative shortage of high-quality talents in the industry. In the process of global competition, high-level R&D and management personnel with international vision and experience are crucial for the development of enterprises. The research and development, processing technology design, and other technical requirements for polyacrylamide formulas are high, requiring professional R&D personnel to continuously innovate and improve the existing product system and develop new formulas. R&D personnel need years of work, learning, and practical accumulation to possess the required professional technical knowledge. At the same time, as specialized fine chemical products, there are numerous types of additives for tertiary oil recovery and fracturing extraction, and their customized characteristics are prominent. It is necessary to provide suitable polyacrylamide products according to the specific reservoir characteristics and extraction degree of different oil fields.

The different types of polyacrylamide products and their application technologies mentioned above directly affect the product effectiveness and oilfield recovery rate. Therefore, the use of products requires professional technical guidance based on specific application environments and customer needs. Therefore, suppliers usually need to deploy experienced professional technical service personnel to promptly solve various problems during product use for customers and ensure efficient product use.

5-5. [Safety and Environmental Protection Barriers]

The production of fine chemical industry usually involves hazardous chemicals. For the production and operation of hazardous chemicals, enterprises shall construct safety production facilities in accordance with requirements and obtain certificates such as the "Hazardous Chemicals Business License" and "Safety Production License". The construction projects of chemical enterprises need to go through safety condition review, safety facility design review, trial production review, and safety facility completion acceptance to ensure that the safety facilities meet the standards before they can be put into production. Fine chemical enterprises require a large amount of technical and financial investment in equipment, qualifications, and subsequent maintenance for safety production, which forms a high barrier for new entrants.

The fine chemical industry has certain pollution in the production process, and has relatively high requirements for environmental protection, which is regulated by environmental protection departments. In the process of investment and construction projects, the policy of "environmental impact assessment and acceptance" should be implemented. Reasonable arrangements for the treatment of "three wastes" should be made in advance during the project design process, and corresponding investments should be made in environmental protection facilities according to relevant national regulations to ensure that environmental protection facilities are designed, constructed, and put into operation simultaneously with the main project. Enterprises must obtain a pollutant discharge permit in accordance with the law during formal production, and the emissions of major pollutants must meet the national or local emission standards. Industrial solid waste and hazardous waste must be safely disposed of. Based on the increasing trend of domestic environmental protection requirements, new entrants will face higher safety and environmental barriers.

This article also focuses on analyzing the competitive landscape of the polyacrylamide industry, including the competitive landscape of major manufacturers in the global market and the domestic market in China. The article focuses on analyzing the production capacity, sales volume, revenue, price, and market share of major global manufacturers of polyacrylamide, the distribution of global polyacrylamide production areas, the import and export situation of polyacrylamide in China, and industry mergers and acquisitions. In addition, a detailed analysis was conducted on the product classification, application, industry policies, industry chain, production mode, sales mode, favorable and unfavorable factors for industry development, and entry barriers in the polyacrylamide industry.